- Empty cart.

- Continue Shopping

Russian Gold Ruble and Chinese Petro-Yuan: Shifting Global Economic Axis. Putin grabbed gold bricks firmly.

The war in Ukraine has far reaching implications across the entire world. Facing major sanctions from the West, Russia has decided to support it’s falling currency with a defacto gold standard, as well as to start making oil and gas deals in Europe exclusively in Rubles. Inspired by the Russian move, China has decided to introduce the petro-Yuan as well.

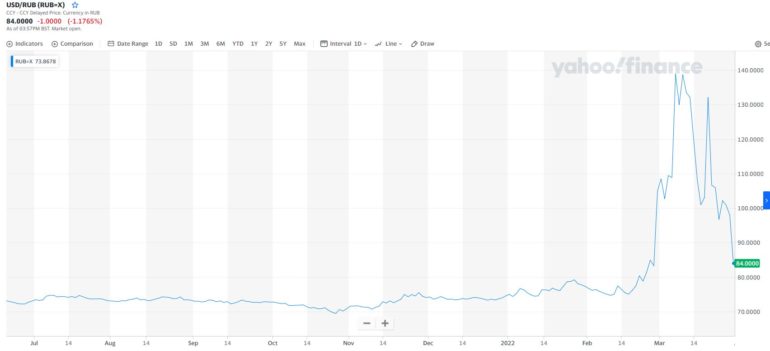

All currencies used to be backed by the gold standard. The gold standard means that for every banknote you have, you could theoretically go and exchange the banknote for a fixed amount of gold. This has many limitations, but it does control inflation (since the government can’t just print money to get out of trouble), but also, it makes the currency valuable for foreign investors, since investing in the currency is like investing in gold and government bonds at the same time (this is not financial advice, but buying gold is always a safe investment since there’s a limited amount of it and it holds it’s value against inflation). This is exactly what the Russian Ruble needs! Since the start of the war and the following sanctions, the Ruble dropped down to 140:1 worth of US Dollar, but now it’s slowly getting back to the pre-war levels. This is only going to get better for the Ruble, as US continues to print money. Last year alone, US printed 300 billion dollars, and that’s not counting the digital currency that was issued. The Russian central bank is buying gold at a fixed rate of 500 grams for 5000 Rubles, creating a strong relationship between Gold and Ruble.

On top of that, Russia has demanded that all sales of gas and oil into Europe be done in Rubles as well, instead of Euros and Dollars.

This is a big deal because the US Dollar is sometimes know internationally as the “petrodollar”. On paper, US Dollars are a fiat currency, meaning, their worth isn’t tied to any real object. In practice, all international oil and petroleum deals are done in US Dollars, which means that the worth of the Dollar is tied to oil. However, the petrodollar is like a reverse gold standard. While the gold standard prevents inflation, the petrodollar encourages inflation and printing of money. This is because when the international deals are made in US dollars, they need to buy those dollars from the US in their local currency. So the US can just print the money out of thin air to buy the local currencies, and then go in and buy up local labour and supplies for the currency they got in exchange for absolutely nothing! Yes, the nations who buy the dollar can use it to buy things in America that cost dollars, but because creating the dollars caused inflation, the US government is always getting the better end of the deal (which is why the petrodollar is the anti-gold standard, and encourages inflation). This is a deal so good, that some speculate that US involvement in countries like Libya and Iraq was because it’s leaders wanted to move away from the petrodollar.

Its understandable why Russia wants to sell oil and gas in Rubles, and why they held off until the war started. It’s a tough deal to sell to US and EU, and even now, Western leaders are refusing the deal, and trying desperately to figure out some alternative instead of relying on Russian oil (and giving Russian Ruble so much economical power). And given that USA under Trump was energy independent, it’s entirely possible that the West can break off their dependence on Russia oil and gas – especially if our government wasn’t so against developing our own energy sector, they could have the means to punish Putin for his aggression in Ukraine. But since both Biden and Trudeau have made it their goal to destroy oil projects that could have us supply oil and gas to EU, Putin seems to have picked the best time for his imperial conquest!

At the same time, China is introducing it’s own “petroyuan“, a “a new standardised futures contract available to trade on the Shanghai International Energy Exchange”. What it really means is that China wants in on the petrodollar action. China in general has been supportive of Russia in the invasion. They refuse to put sanctions on Russia, and continue to develop new economic projects together. Since China is a major player in world economics, while the Western World sanctions Russia, Russia has access to Asian and other markets. For example, Russia and India have signed an agreement to trade oil in Roubles, instead of Euros or Dollars.

This is a big deal for China especially since China has a similar situation to Russia that it wants to solve in a similar way. China has been struggling to regain the country of Taiwan, which split away from Mainland China during their communist revolution. Taiwan, despite being a small island, is a major global economic player, being one of the only places to manufacture semi-conductor chips – “TSMC (Taiwan Semiconductor Manufacturing Company) is important because it is pretty much the only place to get processor chips fabricated, unless you’re Intel.” Which is why Taiwan has the money and international influence to resist “soft” attempts at takeover, and an outright invasion threatens to cut off the global supply of semi-conductor chips. Semi conductor chips are used in almost all electronics devices nowadays, so the international community is not going to just sit back and do nothing if China disrupts it’s supply through invasion – at the same time, leaving China in charge of the one of the only places that manufacture semi-conductor chips means that China gets to economically dominate everyone else.

The Chinese government knows this, which is why they’re taking this opportunity to “sanction proof” their economy. They are creating strong economic ties with countries who they know will support their actions (or at least, remain neutral) as well as taking the power away from the superpower that could actually do something about it (ie, USA) with their petro-yuan. The sanctions against Russia don’t seem to be working as well as last time, since Russia had 8 years to refocus it’s economy and come up with counter measures to the sanctions. This means that if the EU and US want to contain Russia’s ambitions and to punish their actions, we are going to have to come up with something different – such as for example, establishing our own energy independence so we can supply Europe. If Justin Trudeau wants to support Ukraine in this conflict, the best thing he can do is to revitalize Canada’s energy sector and continue the pipeline projects he has cancelled, instead of sending weapons and volunteers to fuel the conflict and line the pockets of the Military Industrial Complex.

That’s a good article imho! I agree with your thoughts on currency. I would suggest thinking also about the value of “stability”, which is a very big deal, too. (I mean that the dollar has had stability in the sense that its value has been very predictable, not that the value has been a fixed constant). That makes it very attractive for international trade or any transaction that makes assumptions about future prices. The dollar’s rate of inflation has been predictable enough to be considered a constant, even if the dollar’s value itself has faced constant erosion. Plus, on the banking level, nobody holds dollars anyway. They hold and swap US Treasuries — dollars that magically pay themselves to be held! Not much, but enough to be very attractive.

Well all that goes to pot in face of an inflation tsunami. Which of course we’re seeing. And what currency is heading towards stability while the dollar is falling away from it? The ruble and the yuan come to mind.

Thể thao là mảng thế mạnh của 888slot freebet với hàng nghìn giải đấu lớn nhỏ mỗi năm. Người chơi có thể đặt cược bóng đá, bóng rổ, tennis hay eSports với tỷ lệ kèo cạnh tranh và cập nhật liên tục theo thời gian thực. TONY01-06S